Committed to Creating Shareholder Value

Disciplined Strategy

Sitio is a shareholder returns driven company focused on large-scale consolidation of high-quality oil and gas mineral and royalty interests across premium basins, with a diversified set of top-tier operators. Sitio has an objective of generating cash flow from operations that can be distributed to shareholders and reinvested to expand the company’s mineral and royalty interest portfolio.

Acquisition Underwriting Criteria

- Strong preference for relationship-driven, privately negotiated acquisitions vs. broad auction processes

- Prioritize Permian-focused assets to leverage extensive in-basin experience

- Thoroughly diligence land, geology, and engineering data

- Understand depth of line-of-sight inventory

- Focus on relative valuation on equity-for-equity transactions

- Target mineral and royalty interests under operators with strong environmental track records

We are focused on efficiently allocating capital, maintaining balance sheet strength, and maximizing long-term value for its shareholders.

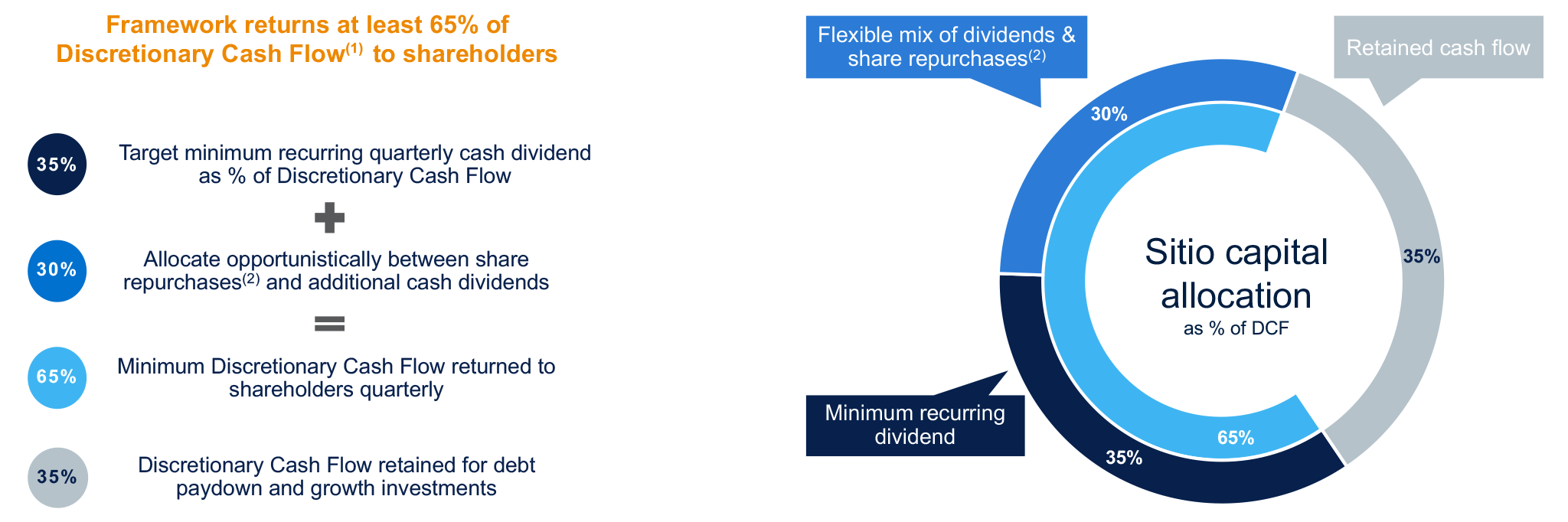

Sitio targets returning at least 65% of Discretionary Cash Flow and using retained cash flow to protect the balance sheet, maintain liquidity and fund cash acquisitions. As a mineral and royalty interest owner, Sitio’s capital requirements are fully discretionary and there are no required drilling and completion capital expenditures or lease operating expenses.

(1) Discretionary Cash Flow defined as adjusted EBITDA less cash interest and cash taxes

(2) Share repurchases to be executed at the discretion of the Company and through a variety of methods. The Company is not obligated to purchase any dollar amount or number of shares under the repurchase program

Our Heritage

Sitio’s original predecessor company was formed in November of 2016. The company completed more than 175 acquisitions from inception through the reverse merger with Falcon Minerals in June of 2022, in which the company became a publicly traded entity, was renamed Sitio Royalties Corp., and began trading on the NYSE under the stock ticker “STR”.

- November 2016

Sitio's original predecessor formed with the objective of consolidating oil & gas royalties in the Delaware Basin - December 2016

Closed on first mineral and royalty interest acquisition, purchasing ~4,000 NRAs from a private seller - September 2019

Acquired ~7,300 NRAs from Desert Royalty Company in the Delaware Basin - June 2021

Closed acquisition of Rock Ridge Resources in a private, all stock, transaction, which included ~18,500 NRAs - August 2021

Closed acquisition of Source Energy in a private, all stock, transaction, which was the Company's first step into the Midland Basin and, at 25,000 NRAs, was the largest Company acquisition at the time - January 2022

Announced all stock reverse merger with Falcon Minerals, which included ~34,000 NRAs in the Eagle Ford and Appalachia - June 2022

Closed reverse merger with Falcon Minerals and renamed company to Sitio Royalties Corp - June 2022

Announced acquisition of ~31,900 NRAs from Foundation Minerals and Momentum Minerals for a combined ~$550 million - August 2022

Sitio paid its first dividend as a public company - December 2022

Closed all stock acquisition with Brigham Minerals, the largest public mineral and royalty transaction to date, adding ~86,000 NRAs - December 2023

Closed sale of Appalachia and Anadarko Basins for $117.5 million, divesting ~22,500 NRAs - April 2024

Closed on acquisition of ~13,000 NRAs in the DJ Basin